north dakota sales tax exemption

Groceries are exempt from the North Dakota sales tax. Form NDW-R - Reciprocity Exemption from Withholding for Qualifying Minnesota and Montana Residents Working in North Dakota 2022 Individual Income Tax Form ND-1ES - 2022.

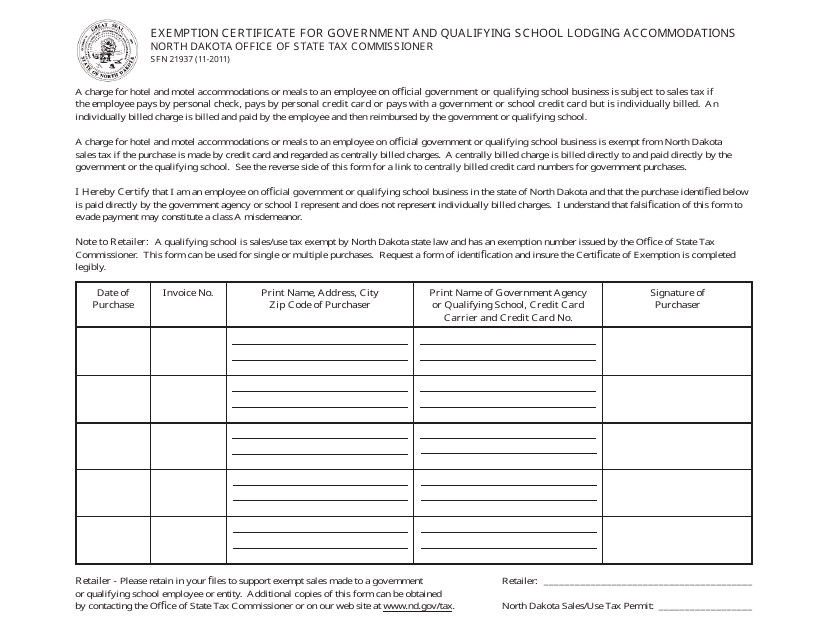

State Lodging Tax Requirements

Signed by new owner with tax exemption and lienholder information if applicable.

. Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104 Fargo ND. 24 rows Sales Tax Exemptions in North Dakota. This can be regularly attained simply by making.

How to use sales tax exemption certificates in North Dakota. Groceries are exempt from the North Dakota sales tax. North Dakota has a statewide sales tax rate of 5 which has been in place since 1935.

North Dakota Sales Tax Exempt Form An employee must be able to make sales in order to be exempt from sales tax. No Sales Tax Exemption Available. In-State Sales Tax Exemption is NOT Available but.

Carbon dioxide for enhanced recovery of oil and gas. A North Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. Sales TaxChurches in North Dakota.

Exempt from North Dakota sales tax. The gross receipts from sales of drugs that are sold under a doctors prescription for use by a person are exempt from sales tax. If vehicle is less than nine 9 years old SFN 18609 Damage Disclosure Statement must be completed by.

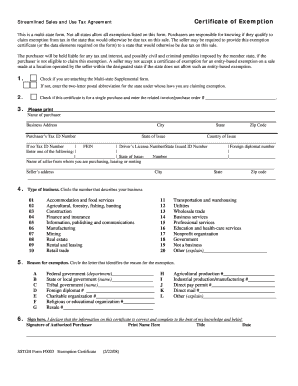

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. Remote sellers with no physical presence in North Dakota are required to collect state and local sales tax on taxable sales made into North Dakota unless they qualify for the small seller. Agricultural production equipment that qualifies as used farm machinery farm machinery repair parts used irrigation equipment and irrigation repair.

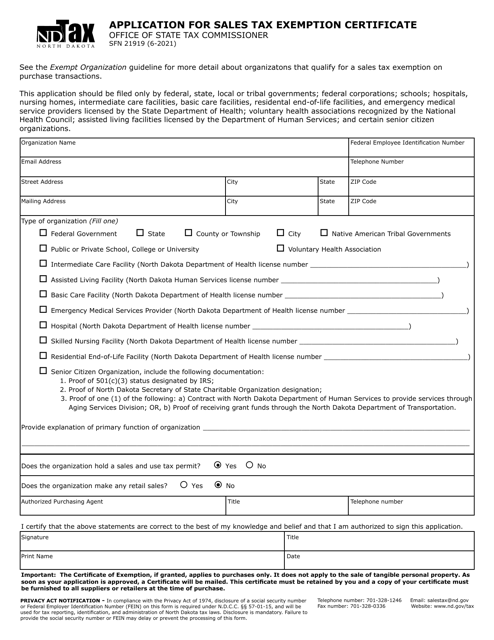

To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail. Items shipped to North Dakota qualify for a tax. Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of 8.

Occasionally questions arise if churches are exempt from paying sales tax on purchases or if they are obligated to pay sales tax if they sell religious. No form is needed. Products Exempt from Sales Tax A.

Public schools are considered instrumentalities of state government and are exempt from North Dakota sales and use tax on all purchases made by the school if payment is made directly to. Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of 8. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges.

North Dakota has several sales tax exemptions by industry including. In North Dakota certain items may be exempt. Agricultural commodity processing plant construction materials.

In the state of North Dakota sales tax is legally required to be collected from all.

Form Rv 093 Fillable Sales Tax Exempt Status Application

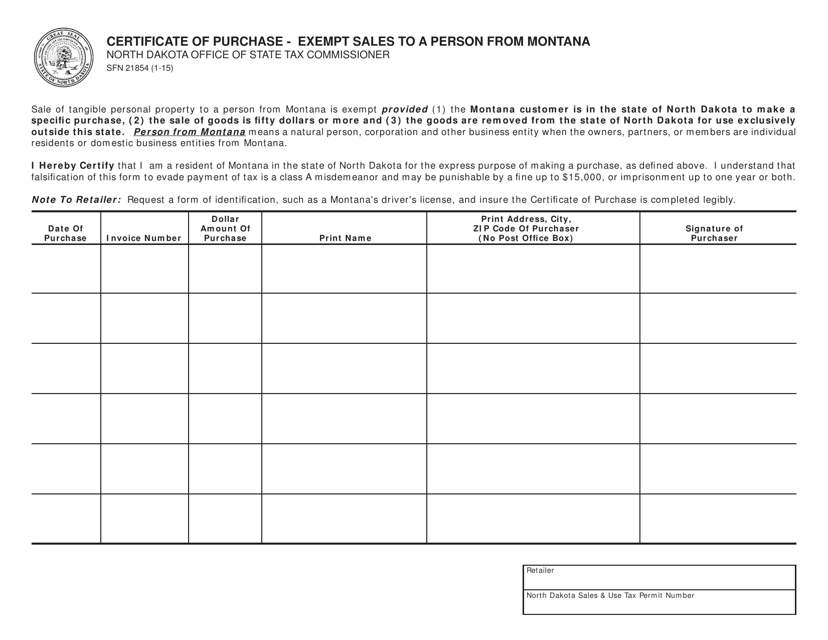

Form Sfn21854 Download Fillable Pdf Or Fill Online Certificate Of Purchase Exempt Sales To A Person From Montana North Dakota Templateroller

How To Use A North Dakota Resale Certificate Taxjar

North Carolina Tax Form Manualzz

Form 21919 Application For Sales Tax Exemption Certificate

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Form 21999 Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

Form Sfn21937 Download Fillable Pdf Or Fill Online Exemption Certificate For Government And Qualifying School Lodging Accommodations North Dakota Templateroller

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

.png)

States Sales Taxes On Software Tax Foundation

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Printable South Dakota Sales Tax Exemption Certificates

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue

Bill Of Sale Form North Dakota Tax Power Of Attorney Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller